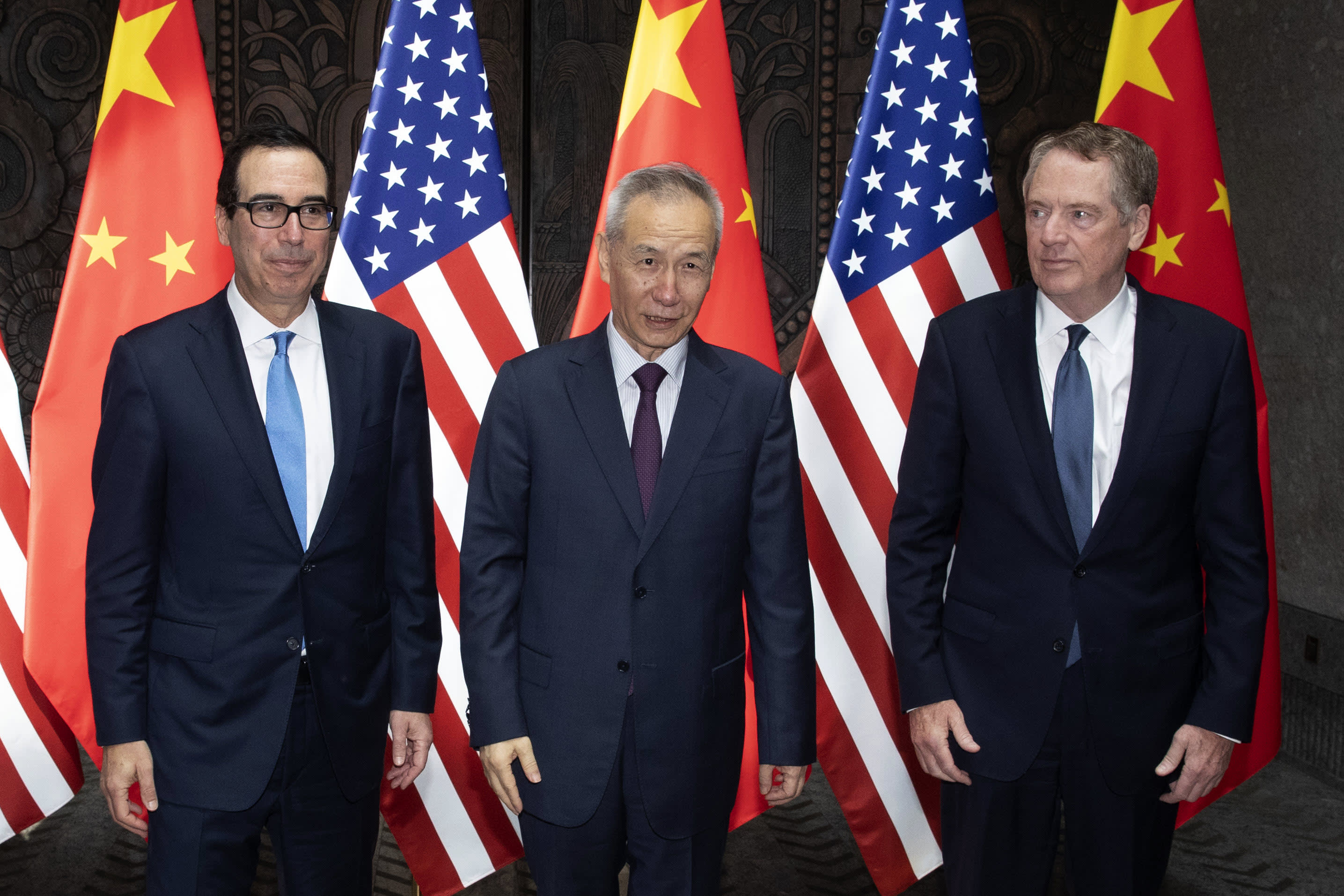

Chinese Vice Premier Liu He (C) with United States Trade Representative Robert Lighthizer (R) and Treasury Secretary Steven Mnuchin (L) pose for photos before holding talks at the Xijiao Conference Center in Shanghai on July 31, 2019

Ng Han Guan | AFP | Getty Images

The stock market's race to new highs could be put to the test in the coming week by two events — the signing of a phase one trade deal with China and the start of corporate earnings season.

Stocks have been gaining steadily since it became clear late last year that the U.S. and China reached a truce and would agree to a phase one deal, rolling back some tariffs and avoiding new ones. But details of that deal have never been made clear, so markets will be focused on any information that will clarify how it will be implemented and what checks and balances there are to ensure compliance.

The market has also reached a lofty premium that could be challenged if earnings disappoint, though analysts widely expect to see the majority of companies able to beat lowered expectations.

Banks are first up with J.P. Morgan Chase, Citigroup and Wells Fargo releasing earnings Tuesday, and Bank of America and Goldman Sachs reporting on Wednesday. Earnings could be a slight positive for the market, analysts say.

"I think earnings are going to be a good component," said Michael Arone, chief investment strategist, U.S. SPDR Business at State Street Global Advisors. "Companies have lowered the bar enough to where I think most of the companies will easily step over it, and we'll all have a sigh of relief that the earnings this quarter won't be as bad as it could have been. It won' be strong. We've seen revisions across all of the sectors come down."

According to Refinitiv, fourth quarter earnings are expected to be down 0.6%, based on results of companies that have already reported and estimates for others that have not.

Stocks started out the past week worried about a blowup in the Middle East, after the U.S. killed Iran's top general. But by midweek, tensions dissipated and stocks were higher. On Friday, stocks sold off again, after a lackluster jobs report, though the Dow briefly topped 29,000 for the first time. The S&P 500 was up 0.9% for the week, at 3,265, and the Dow was off 0.7% at 28,823.

The China trade deal is expected to be signed on Wednesday, and while it may be a nonevent, it has the potential for surprises. The deal most likely will be seen as a positive, but it is not expected to do much to curb technology transfers, which are expected to be part of the next phase discussions.

"If the deal is more watered down than anticipated, if there's skepticism about how China will adhere to its promises" it could be negative, Arone said. "There's skepticism already. If there's something in the details that suggest doubt about how are we going to police this or how are we going to enforce this, I think that could cause markets to move some."

Peter Boockvar, chief investment strategist at Bleakley Advisory Group said he thinks the market has moved past the trade news. "I think they'll try to emphasize some IP protection. I honestly think people have already moved on," he said. President Donald Trump has also lowered expectations by noting that the next phase of the deal would not come until after the election.

Economy

Markets also will focus on some of the upcoming data in the week ahead, particularly CPI inflation data Tuesday and retail sales for December on Thursday.

Core CPI is expected to increase by 0.2%, putting the annual pace at 2.3%, and retail sales are expected to rise by 0.3%.

"The holiday season when all was said and done should have been pretty good. You had low gas prices, rising wages and a super tight labor market. It has to be good," said Joseph LaVorgna, Natixis chief economist Americas.

There is also a parade of Fed speakers in the coming week, but they are unlikely to offer any clues about when the Fed will move off the sidelines. Boston Fed President Eric Rosengren, who voted against the Fed's rate cuts three times last year, speaks Monday. There are a half dozen more appearances by other Fed officials, including Dallas Fed President Rob Kaplan, who speaks Wednesday.

LaVorgna said the Fed could begin to focus more on the rapid rise in the stock markets, as Kaplan did this past week. "It seems to me the hawks might worry about financial instability and the market being excessively exuberant," said LaVorgna.

Week ahead calendar

Monday

Earnings: Shaw Communications

10:00 a.m. Boston Fed President Eric Rosengren

12:40 p.m. Atlanta Fed President Raphael Bostic

2:00 p.m. Federal budget

Tuesday

Earnings: Citigroup, JPMorgan Chase, Wells Fargo, Delta Air Lines, First Republic Bank, Wipro, IHS Markit

6:00 a.m. NFIB survey

8:30 a.m. CPI

9:00 a.m. New York Fed President John Williams at London School of Economics

1:00 p.m. Kansas City Fed President Esther George

Wednesday

Earnings: Bank of America, BlackRock, Goldman Sachs, UnitedHealth, US Bancorp, PNC Financial, Alcoa, Eagle Bancorp, Hancock Whitney

8:30 a.m. PPI

8:30 a.m. Empire state manufacturing

10:45 a.m. Philadelphia Fed President Patrick Harker

12:00 p.m. Dallas Fed President Robert Kaplan

2:00 p.m Beige book

Thursday

Earnings: Morgan Stanley, Taiwan Semiconductor, Bank of NY Mellon, Charles Schwab, PPG Industries, HomeBancShares, Bank of the Ozarks, People's United Financial

8:30 a.m. Initial claims

8:30 a.m. Retail sales

8:30 a.m. Import prices

8:30 a.m. Philadelphia Fed

8:30 a.m. Business leaders survey

10:00 a.m. Business inventories

10:00 a.m NAHB

4:00 p.m TIC

Friday

Earnings: Schlumberger, Citizens Financial, Fastenal, Kansas City Southern, Regions Financial, State Street, First Horizon

8:00 a.m. Philadelphia Fed President Patrick Harker

8:30 a.m. Housing starts

9:15 a.m. Industrial production

10:00 a.m. Consumer sentiment

10:00 a.m. JOLTS

"Market" - Google News

January 11, 2020 at 04:57AM

https://ift.tt/2QHOsmQ

Trade deal and earnings season could shape the market's next moves - CNBC

"Market" - Google News

https://ift.tt/2Yge9gs

Shoes Man Tutorial

Pos News Update

Meme Update

Korean Entertainment News

Japan News Update

Bagikan Berita Ini

0 Response to "Trade deal and earnings season could shape the market's next moves - CNBC"

Post a Comment